Africa's economic landscape features diverse currencies, some facing significant depreciation. At the start of 2026, several stand out as the weakest based on their exchange rates against the US dollar. This article ranks them, explains causes, and discusses implications. Data reflects mid-market rates from reliable sources in early February 2026.

Factors Behind Weak Currencies in Africa 2026

Economic instability drives currency weakness. High inflation erodes purchasing power. Political unrest disrupts markets. Reliance on commodity exports exposes nations to global price swings. External debt burdens force devaluations. Limited foreign reserves hinder central banks from stabilizing rates. These issues persist across many African economies in 2026.

Top 10 Weakest African Currencies List

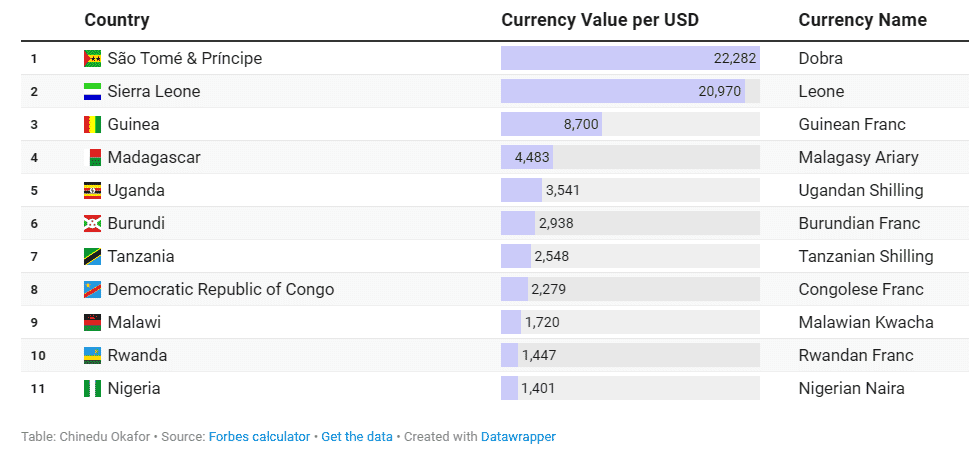

Experts measure weakness by units needed to buy one US dollar. Higher numbers indicate weaker currencies. The following table lists the top 10.

Source: Business Insider

1. São Tomé & Príncipe Dobra (STN) – Weakest African Currency

USD is equivalent to over 22,000 Dobra, making the STN the most devalued currency in Africa. Small island economies struggle with import costs and limited export diversity.

2. Sierra Leonean Leone (SLL)

Trading at around 20,900 SLL per 1 USD, the Leone remains one of Africa’s weakest due to high inflation and constrained economic output.

3. Guinean Franc (GNF)

The Guinean Franc requires nearly 8,700 units to buy one dollar, reflecting continued depreciation from political instability and limited economic diversification.

4. Malagasy Ariary (MGA)

In Madagascar, 4,400+ MGA trade for one US dollar as ongoing economic and political challenges weigh on currency strength.

5. Ugandan Shilling (UGX)

The Ugandan Shilling trades at around 3,500+ UGX per USD, weakened by trade deficits and reliance on imports despite infrastructure spending.

6. Burundian Franc (BIF)

Burundi’s BIF exchanges at roughly 2,900+ per dollar, constrained by low export volumes and narrow foreign earnings.

7. Tanzanian Shilling (TZS)

At about 2,500+ TZS per USD, the Tanzanian Shilling persists as one of East Africa’s weakest currencies, influenced by trade gaps and inflation pressures.

8. Congolese Franc (CDF)

The Congolese Franc, at over 2,200 CDF per dollar, remains weak despite DR Congo’s mineral wealth due to political risk and governance challenges.

9. Malawian Kwacha (MWK)

In Malawi, the Kwacha trades near 1,700+ per dollar, impacted by forex shortages and fiscal constraints.

10. Rwandan Franc (RWF)

Rounding out the top 10, the Rwandan Franc exchanges at roughly 1,400+ RWF per 1 USD, weakened by trade imbalances and limited export diversity.

Why These Currencies Are Weak

Several shared factors contribute to weak currency values across these African countries:

- High Inflation: Rapid price increases erode purchasing power and undermine investor confidence.

- Trade Deficits: More imports than exports increase demand for foreign currency.

- Limited Foreign Reserves: Central banks cannot fully defend local currency values.

- Political Instability: Discourages investment and raises economic risk.

- Debt Pressures: Heightened external obligations weaken fiscal and monetary stability.

Economic Impacts of Weak Currencies in Africa

Weak currencies raise import costs, fueling inflation. Consumers pay more for goods. Businesses face higher expenses, reducing competitiveness.

Yet, they boost exports by making products cheaper abroad. Tourism benefits as visitors find bargains.

Governments borrow expensively, increasing debt. Policies like rate hikes combat inflation but slow growth.

Investors eye opportunities in undervalued assets. Remittances gain value, supporting households.

Read More

Top 10 Countries with Highest Debt in the World 2026

Top 10 Countries with Highest Debt in the World 2026