Dangote Refinery stands at the forefront of a seismic shift in the global oil industry. Refinery shutdowns in Europe and the United States create unprecedented opportunities for Nigeria's massive facility. Analysts predict substantial gains as tightened fuel markets drive demand for Dangote's products.

This development not only bolsters Nigeria's economy but also redefines Atlantic Basin trade flows. Industry experts from Kpler highlight how closures of nearly 800,000 barrels per day (bpd) in refining capacity across these regions materially tighten product balances, especially for middle distillates like diesel.

Europe faces a wave of refinery closures amid economic pressures and environmental regulations. Plants struggle with high operational costs and competition from efficient newcomers. The United Kingdom's Grangemouth and Germany's Wesseling refineries risk early shutdowns due to oversupply and declining margins.

FGE analysts note that certain European refineries lack the technology to upgrade gasoline to meet stringent U.S. and EU specifications. This vulnerability exposes them to losses in key export markets, particularly West Africa, where Dangote now dominates.

In the United States, refinery activity declines due to maintenance outages and strategic reductions. Sanctions on Russian oil exacerbate global diesel shortages, pushing prices higher.

The U.S. Energy Information Administration reports widened diesel crack spreads since late October, reaching yearly highs. Outages at facilities like Kuwait's Al Zour refinery further strain supplies, making Dangote's output crucial for filling gaps in the Atlantic Basin.

Western Refinery Capacity Faces Historic Decline

The global refining industry stands at a critical crossroads. Over 800,000 barrels per day of Western refining capacity is scheduled to shut down in 2025 and 2026, creating supply gaps that new entrants can exploit. This represents one of the most significant capacity reductions in recent decades.

United States refining capacity may fall by as much as 402,476 barrels per day by 2026 due to permanent closures. Major facilities including the LyondellBasell Houston refinery, Phillips 66 Los Angeles plant, and multiple California refineries have announced shutdowns.

These closures stem from mounting economic pressures, stringent environmental regulations, and declining gasoline demand driven by electric vehicle adoption.

European refiners face even steeper challenges. Nearly 400,000 barrels per day of European capacity is scheduled for permanent closure in 2025, including major facilities in Scotland, Germany, and other key markets. The Grangemouth refinery in Scotland, Shell's Wesseling facility in Germany, and a significant portion of BP's Gelsenkirchen refinery represent substantial capacity leaving the market.

Dangote Refinery's Strategic Advantages Amid Shutdowns

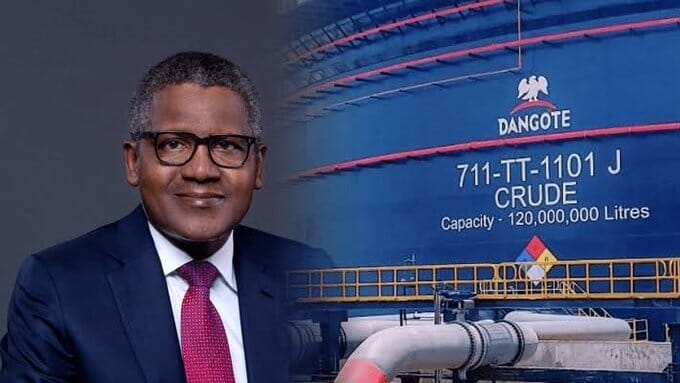

Dangote Refinery ramps up production and exports, capitalizing on these disruptions. The 650,000 bpd facility near Lagos achieves record crude intakes, processing up to 595,000 bpd in July. It exports high-quality gasoline to the U.S. and jet fuel to the Middle East, meeting Euro V standards. Devakumar Edwin, Dangote's executive director, emphasizes the refinery's flexibility in sourcing crude from Nigerian, West African, and U.S. grades. This adaptability ensures steady operations despite global volatility.

The refinery's expansion plans amplify its gains. Owners target a doubling to 1.4 million bpd by 2028, positioning Dangote as a major diesel supplier to Europe.

As European throughput shrinks, Dangote redirects flows, shifting long-haul shipments from West Africa. This change reduces reliance on U.S. medium-range tankers and favors longer routes, benefiting product tanker economics in certain segments.

Nigeria's government supports this growth through crude-for-naira arrangements, conserving foreign exchange and stabilizing the local currency. The Nigerian National Petroleum Company Limited ends its exclusive purchase deal, allowing direct marketer access.

This move eliminates subsidies, aligns prices with costs, and enhances market efficiency. Dangote delivers world-class fuels domestically, ending eras of substandard imports and fuel scarcity.

Impact on Global Fuel Markets and Trade Dynamics

Refinery shutdowns in Europe and the US reshape global fuel markets. Kpler data shows tightened balances push diesel prices upward, with Europe remaining structurally short. The International Energy Agency raises European throughput forecasts but warns of exacerbated import needs due to closures.

Global refining profits surge 76 percent amid outages, sanctions, and maintenance at plants like Nigeria's Dangote and Kuwait's Al Zour.

Dangote's ramp-up disrupts traditional trade routes. West Africa, once dependent on European gasoline, now sources locally. This shift cuts Europe's $17 billion annual gasoline trade to Africa.

Analysts from Reuters predict accelerated decline for European refiners, with 300,000 to 400,000 bpd at risk. The refinery's residue fluid catalytic cracker (RFCC) outages temporarily add fuel oil supply, but overall, it strengthens global balances.

In Asia, blending hubs like Singapore absorb extra feedstocks from Dangote's operations. This dynamic weakens European fuel oil prices but supports Asian demand. Geopolitical factors, including EU sanctions on Russia, limit supplies and elevate crack spreads. U.S. refiners sell into high-priced international markets, influencing domestic prices.

Future Projections for Dangote Refinery Gains

Experts forecast continued gains for Dangote as shutdowns persist. Rystad Energy projects global refinery closures removing 10 million bpd by 2030, mostly in Europe and North America. New capacities in the Middle East and Africa, like Dangote, fill voids. The refinery's focus on high-value products positions it to capture European export markets in West Africa.

Challenges remain, including operational setbacks like reduced crude buys in October due to market strategies. Analysts express skepticism on sustained high rates into 2026, citing potential shutdowns. However, Dangote's management dismisses rumors, affirming ongoing operations with 24-hour loading capacity.

Union actions occasionally disrupt, as seen in a brief shutdown over natural gas supplies. Yet, resilience shines through diversified feedstocks and strategic partnerships. Ghana's Sankofa crude shipments adjust mixes amid European import declines.

Economic experts like Prof. Ken Ife assert that nearly five refineries shut down due to Dangote's competitive edge. More closures loom as older plants lack quality advantages. This trend underscores Dangote's role in Africa's petroleum self-sufficiency.

Investors eye opportunities in this evolving landscape. Tightened markets promise higher margins for efficient refiners. Dangote's exports to envious European markets highlight its global competitiveness. The refinery not only boosts Nigeria's output accounting for 63 percent of West Africa's diesel from India, but also inspires regional development.

As Europe and the US grapple with closures, Dangote emerges as a powerhouse. It transforms challenges into gains, driving economic growth and energy security. Stakeholders monitor progress closely, anticipating further reshaping of oil trade.

Read More

- 7.5% VAT on Mobile Transfers and USSD Transactions Explained Simply

- Paystack Acquires Ladder Microfinance Bank to Enter Nigeria’s Banking Sector

- Nigeria and UAE Sign Historic Tariff Free Trade Agreement Covering Goods and Services

- Here Are 21 Banks That Have Met the New CBN Recapitalization Requirement