The World Bank stands as one of the planet’s most powerful engines for economic development, poverty reduction, and infrastructure growth. Since its founding, it has lent trillions of dollars to low and middle income nations. But this lifeline comes at a cost: mounting sovereign debt. As of 2023, total outstanding World Bank debt surpassed $437bn, distributed across over 100 countries.

Established in 1944 at the Bretton Woods Conference, the World Bank—formally the International Bank for Reconstruction and Development (IBRD)—initially aimed to rebuild Europe after World War II. Over time, its mission shifted to reducing poverty and fostering sustainable development in low and middle income countries. Alongside its sister institution, the International Development Association (IDA), it provides loans, grants, and expertise to help governments tackle ambitious projects.

These loans are lifelines for many countries, funding everything from bridges to healthcare systems. But they come with a catch: repayment with interest. For some nations, this debt to the World Bank has grown significantly, raising questions about its impact on their people and economies. In this blog post, we’ll dive into the top countries with the highest debt owed to the World Bank, explore why they borrow, and reflect on the human stories behind the numbers—both the triumphs and the struggles.

Top Countries with the Highest Debt to the World Bank

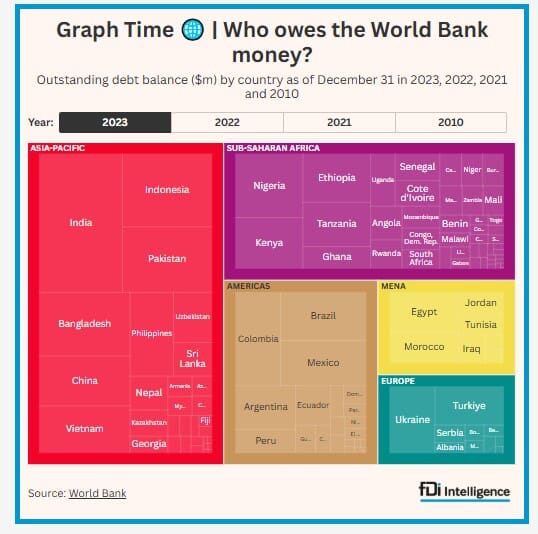

As of the end of 2023, a handful of countries stand out as the World Bank’s largest debtors. Here’s a look at the top five, based on the most recent available data.

- India - $39.3 billion: India, home to over 1.4 billion people, tops the list. Its debt grew by $1.03 billion from 2022 to 2023, though it’s slightly down from a 2021 peak of $39.7 billion.

- Indonesia - $22.2 billion: Nearly half of India’s total, Indonesia’s debt reflects its efforts to bolster infrastructure and resilience against natural disasters.

- Pakistan - ~$20 billion: Pakistan’s debt hovers around the $20 billion mark, supporting its push for energy and social welfare improvements.

- Bangladesh - $19.8 billion: Close behind, Bangladesh uses these funds to combat poverty and climate challenges in one of the world’s most densely populated nations.

- China - $15.4 billion:Though a global economic giant, China still borrows from the World Bank for targeted development in its less prosperous regions.

These amounts represent outstanding loans from the IBRD (for middle-income countries) and IDA (for the poorest nations). India’s debt, for instance, is almost double Indonesia’s, underscoring its heavy reliance on World Bank support. While these figures are just a slice of each country’s total external debt—China’s, for example, reaches $2.42 trillion overall—they highlight the World Bank’s critical role in development financing.

Why Do These Countries Borrow from the World Bank?

So, why do these nations turn to the World Bank? The answer lies in their pressing development needs—needs that often outstrip domestic budgets or private lending options. The World Bank offers loans with lower interest rates and longer repayment terms than commercial markets, making it a go-to source for countries striving to grow.

A country with a vast population and diverse geography, like India uses World Bank loans to connect rural communities with highways, improve irrigation for farmers, and expand access to education and healthcare. Think of a farmer in Uttar Pradesh whose crops now thrive thanks to better water systems—those are the human wins these loans aim for.

Countries prone to earthquakes and floods, invests in disaster preparedness and urban infrastructure. Picture a family in Jakarta with safer housing or clean water—World Bank funds make that possible.

These loans aren’t just numbers—they’re investments in people, meant to build brighter futures. But what do they achieve, and at what cost?

Benefits of World Bank Loans for Development

Building Foundations: InfrastructureRoads, bridges, and power plants don’t just boost economies—they transform daily life. In India, a new highway might mean a child can get to school faster, or a farmer can sell produce in a distant market. In Indonesia, better ports help goods flow, creating jobs.

Empowering People: Education and HealthEducation and healthcare projects are game-changers. In Bangladesh, World Bank support has boosted school attendance and cut maternal mortality rates. Imagine a mother surviving childbirth or a girl becoming the first in her family to read. These are victories of human potential.

Lifting Communities: Poverty ReductionPrograms like Pakistan’s cash transfers give families breathing room to buy food or medicine. In rural India, agricultural loans mean higher yields and steadier incomes. These efforts chip away at poverty, one household at a time.

Challenges and Risks of High Debt Levels

In 2023, developing countries spent a staggering $1.4 trillion servicing external debt, with $406 billion in interest alone. For IDA-eligible nations—the poorest—interest payments hit $34.6 billion, quadruple the level from a decade ago. When governments prioritize debt over schools or clinics, citizens feel the pinch. A teacher in Pakistan might see her classroom crumble, or a Bangladeshi nurse might lack supplies.

Economic downturns, falling commodity prices, or currency drops can make repayment tougher. If a country like Indonesia faces a disaster it can’t fund, debt piles higher. For people already on the edge, this can mean lost homes or jobs.

Some nations risk a debt trap, borrowing more to stay afloat. Worse, if corruption siphons off funds—though not detailed in our data—it’s the public who suffer, repaying loans without seeing benefits. Transparency, as World Bank Chief Statistician Haishan Fu says, is key: “Knowing what a country owes and to whom is essential for better debt management and sustainability.”

Expert Opinions and Future Outlook

Experts call for balance. The World Bank’s Debt Sustainability Framework helps gauge if countries can handle their debt, flagging risks early. But broader fixes—like more aid during crises or fairer loan terms—are gaining traction. Reforming global finance could ease the burden on nations like Bangladesh or Pakistan, ensuring debt fuels growth, not hardship.

The top countries indebted to the World Bank—India, Indonesia, Pakistan, Bangladesh, and China—show us the power and peril of development loans. These funds build schools, save lives, and pave roads to progress, touching millions with hope. Yet, the rising cost of repayment and risks of mismanagement demand vigilance. For every dollar borrowed, there’s a human story of a child learning, a family eating, or a community surviving a storm. By prioritizing sustainability and fairness, we can ensure these loans lift people up, not hold them back. After all, development isn’t just about numbers it’s about lives.